It was good to meet up with old friends and make some new ones at the QA Financial Forum 2023. There were a number of talks and panel discussions to listen to and learn from this year, ranging from European regulations to Chaos testing, and with a rich vein of AI/ML as a regular theme through the talks.

In the morning we had a panel on Digital resilience, discussing where technology meets compliance. It was fascinating to hear how different organisations are approaching this issue, and the levels of regulation they now need to comply with across on premise and in the cloud technologies. For example, DORA regulations from the EU, which will apply from the beginning of 2025. These regulations mean that relevant companies will need to be able to demonstrate their compliance with digital resilience, as well as financial stress tests that banks are already required to be compliant with.

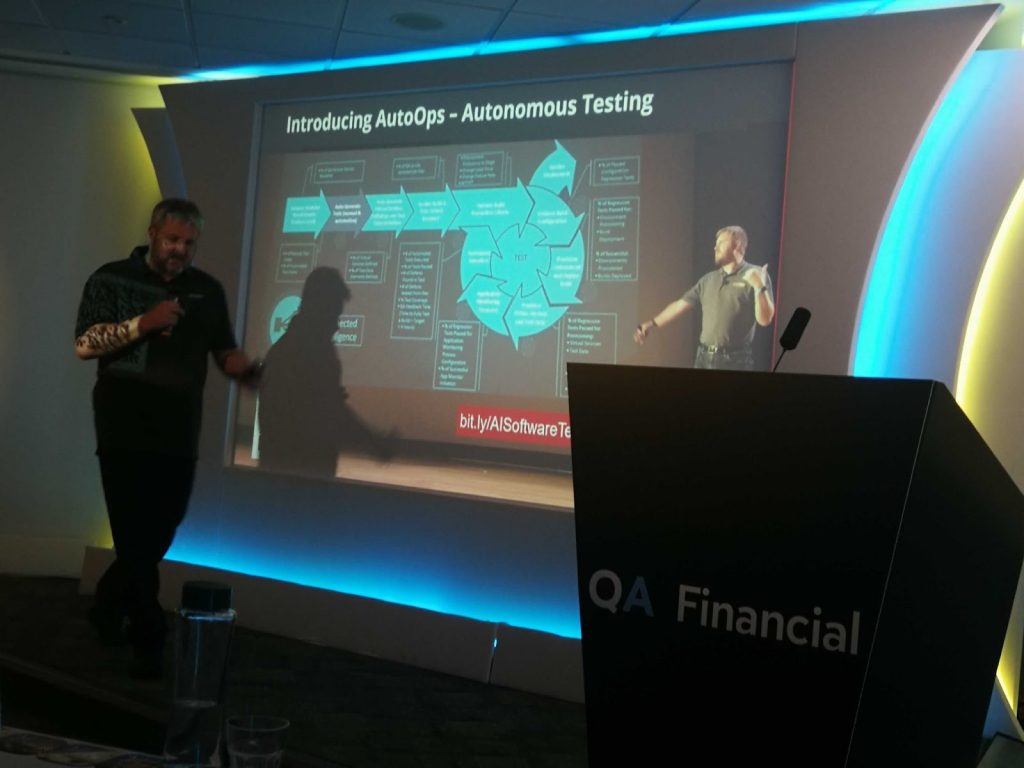

There were several talks in the afternoon that highlighted the importance of AI to the QA process. Whether as a way in which the ‘smarts’ could be built into the testing process, or as something that the testing process needs to be aware of as a part of its environment (e.g. generative AI). And how those experiences could be applied to the financial services testing space.

Two talks that really stood out for me were Chaos (testing) for complex markets and Shape-ing up.

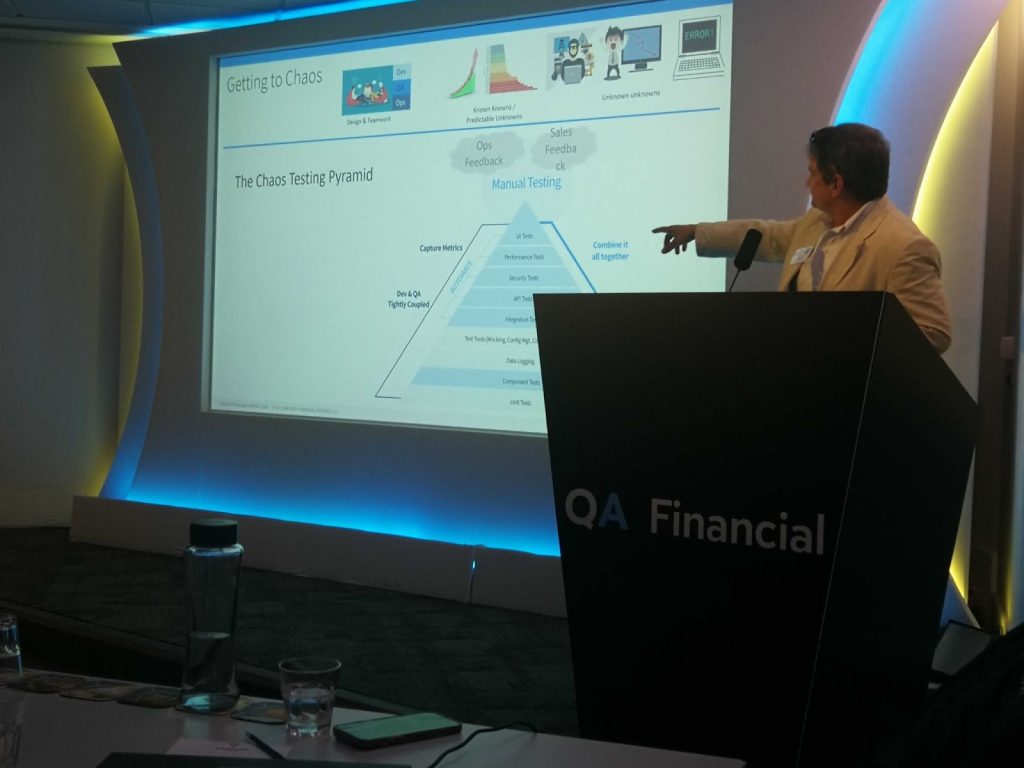

Chaos (testing) for complex markets

Thomas Long from oneZero Financial Markets gave us a great insight to why it can be useful to test beyond the obvious. He referenced Netflix’s Chaos Monkey and demonstrated how this approach can be integrated into a QA team’s testing practice to improve the quality of the software delivered. Chaos testing finds bugs that regular structured, planned testing would be very unlikely to find.

Shape-ing Up

I think my favourite talk was from Griffin Bank’s James Trunk. This talk described how Griffin had taken the Shape Up methodology and bent it a little bit to suit their organisation. The Shape Up methodology is a post-Agile process, where the key addition is to ensure that there is time to ‘sharpen your axe’ in every iteration. In each sprint, in addition to working on features and maintenance, you schedule time to improve your technology and processes too.

One of the key requirements for success in implementing Shape Up at a company is having the right people and the right culture in the organisation. At Caplin we have a culture that values curiosity, innovation and collaboration. We hold regular events like hack days and monthly dev days to practice and foster these values. I think this means we have the right pre-requisites for the Shape Up methodology to be a success, and it is exactly the sort of Agile experiment we would enjoy trialling with one of our teams.

Overall I enjoyed the forum and had multiple takeaways that we can try out as a part of our own QA and development practice. I can’t wait for next year’s!